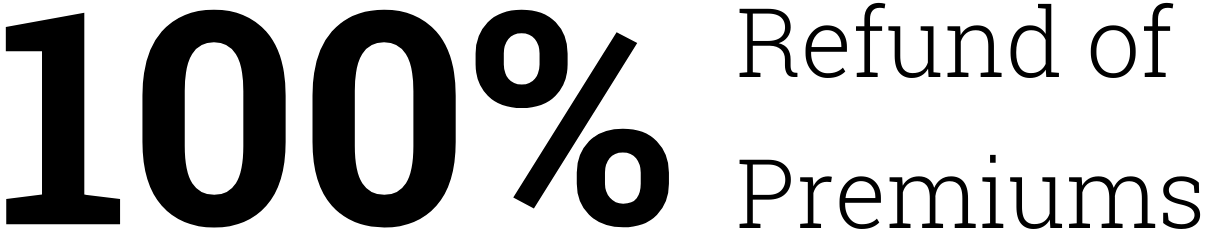

Money-back protection.

|

Accidents and illness are never part of the plan.

Being prepared can be.

No one ever expects a cancer diagnosis or having an accident. Unfortunately, these unplanned events happen. Most people are left unable to work while battling an illness or suffering an injury. As paychecks decrease or even stop, household bills continue. Living expenses, coinsurance, traveling for treatment, and other out of pocket costs can drain savings and put added stress on loved ones.

Our products help provide peace of mind by financially protecting your family, savings, and livelihood. We put money directly in your pocket to help offset lost income, cover your daily bills, plus any unforeseen costs during a medical crisis.

Our products help provide peace of mind by financially protecting your family, savings, and livelihood. We put money directly in your pocket to help offset lost income, cover your daily bills, plus any unforeseen costs during a medical crisis.

Who we help

Individuals & FamiliesWe provide individualized coverage tailored to our clients' needs. Regardless of situation or family status, we have plans that fit any budget to protect what matters most.

|

Small BusinessesOur state-of-the-art plans protect small businesses from losing what they've worked so hard to build. With affordable, tax-deductible* premiums, our coverage secures a safety-net in the unlikely event of a medical catastrophe.

|

Companies |

*Tax laws very from state to state and vary based on company tax status. Consult with a licensed accountant for details on which deductions may apply to your business.

What our clients are saying...

/

- 1

- 2

- 3

- 4

- 5

“I have good health insurance through the union but decided the cancer plan would give me a peace of mind. I found out that I had skin cancer that I needed to have cut out. Family Heritage made my claims process so easy! They deposited $996 directly into my checking account. This helped me pay for the amount my insurance didn’t cover as well as the time I had to take off work for the surgery. I am so thankful I had this policy for something completely unexpected. I know if I ever was in this situation again, or worse, Family Heritage would continue to make claims super easy.”

Cancer Policy Payout: $996

Cancer Policy Payout: $996

-Kady D.

/ Company

- 1

- 2

- 3

- 4

- 5

/

- 1

- 2

- 3

- 4

- 5

“I had insurance through the union while I worked construction. I knew it was a high risk work field so a little extra insurance wouldn’t hurt. Ended up helping a lot after I did have an accident even though I intended to use it as a savings.”

Accident Policy Payout: $4,425

Accident Policy Payout: $4,425

-Cahill M.

/

- 1

- 2

- 3

- 4

- 5

/

- 1

- 2

- 3

- 4

- 5

“I was very grateful to have this policy in place to help with all the extras you don’t think about—hotel stay, gas back and forth, pay for an aide, deductibles, etc. Considering what it cost, it was well worth having and the bonus is that I’m still protected!”

Cancer Claim Payout: $45,944

Cancer Claim Payout: $45,944

-Ricky F.

/

- 1

- 2

- 3

- 4

- 5

/

- 1

- 2

- 3

- 4

- 5

“I was involved in a fall at work, which required me to have surgery and physical therapy. Worker’s Comp was involved, but we were having issues with them. My husband suddenly remembered our policy through Family Heritage and we were very grateful for the amount we received. The claims process was very fast and quick. The funds were electronically transferred and helped a lot. I would highly recommend to anyone.”

Accident Policy Payout: $5,025

Accident Policy Payout: $5,025

-Loriann P.

/

- 1

- 2

- 3

- 4

- 5

/

- 1

- 2

- 3

- 4

- 5

“I am so relieved by having a Family Heritage cancer policy. My co-pays, doctor visits, testing, etc. and car expenses for travel to and from was definitely a burden on my regular income. This has lifted great stress from me and I recommend it to my family and friends often.”

Cancer Policy Payout: $101,932

Cancer Policy Payout: $101,932

-Sarah R.

/

- 1

- 2

- 3

- 4

- 5

/

- 1

- 2

- 3

- 4

- 5

“Glad we had Family Heritage to help with the bill the others didn’t cover while I was in the hospital and off work 12 weeks. Thanks.”

Intensive Care Policy Payout: $6,100

Intensive Care Policy Payout: $6,100

-Richard B.

/

- 1

- 2

- 3

- 4

- 5

/

- 1

- 2

- 3

- 4

- 5

“When Phil presented the policies to me, I saw the value in them, but I was worried about the cost. What helped me find the value was the return of unused premiums... That made it worth it. Then, less than a year into the policy my wife had a stroke and we were able to use the policy. Thank God I bought them!”

Heart Policy Payout: $8,400

Heart Policy Payout: $8,400

-A. Rodgers

/

- 1

- 2

- 3

- 4

- 5

- 0

- 1

- 2

- 3

- 4

- 5

- 6

Cash to you when you need it mostWhen an illness or accident happens, your world stops, but your bills don't. Getting the best care for you or a loved one is costly and time consuming. Most families cannot anticipate what the overall expense will be. That's why our policies put money in your hands to use as you see fit. We offer a variety of options tailored to your concerns and needs, helping you protect what matters most.

|

Our products

CancerCancer impacts millions of Americans each year, and millions more are left feeling overwhelmed when the disease strikes a family member.

HospitalizationWhether planned or unplanned, a hospital stay can be stressful for both the patient and family.

|

AccidentsWhile none of us can predict when an accident will occur, we can certainly be prepared for them.

Intensive CareSevere illness or injury often strikes without warning and can require a stay in the intensive care unit.

|

Heart & StrokeThe number of people suffering from heart attacks and strokes is historically high and expected to rise.

LifeLife insurance can help provide the ultimate protection for your family, easing financial burdens for your loved ones in the event of your premature death.

|